Quick Answer: LivePaye is a fintech aggregator that allows businesses to accept payments from over 20 African countries through a single API. With coverage of 85% of all mobile money in Africa, instant settlements, and a developer-first approach, it's an essential solution for SaaS companies expanding pan-Africa.

If you are building a digital business in Africa, you face a unique problem: Credit card penetration is low, but Mobile Money is king.

According to the GSMA State of the Industry Report, Sub-Saharan Africa processed over $1.1 trillion in mobile money transactions last year, accounting for nearly two-thirds of the global total.

The challenge? The market is incredibly fragmented. You have MTN in Uganda, M-Pesa in Kenya, and Orange Money in West Africa. Integrating these one by one is a developer's nightmare.

Enter LivePaye.

Based in Kampala, Uganda, LivePaye has emerged as a robust payment aggregator that allows businesses to accept payments from over 20 African countries through a single API. In this deep dive, we'll look at their coverage, pricing, and whether they are the right solution for your startup.

LivePaye is a fintech aggregator that bridges the gap between online businesses and local African payment methods. While global giants like Stripe handle credit cards perfectly, they often fail to capture the millions of customers who prefer paying via their phone carrier wallets.

LivePaye solves this by offering a "Single API" solution. You integrate them once, and you can instantly accept payments from:

- Mobile Wallets: MTN, Airtel, Wave, Orange, Moov, TMoney, Free Money.

- Cards: Visa and Mastercard (local and international).

This is LivePaye's "killer feature." They cover 85% of all mobile money in Africa, spanning over 20 countries including Nigeria, Ghana, Uganda, Kenya, Senegal, and Ivory Coast.

For a SaaS looking to expand pan-Africa, this coverage is essential. The World Bank's Global Findex notes that in many African nations, mobile money accounts far outnumber traditional bank accounts.

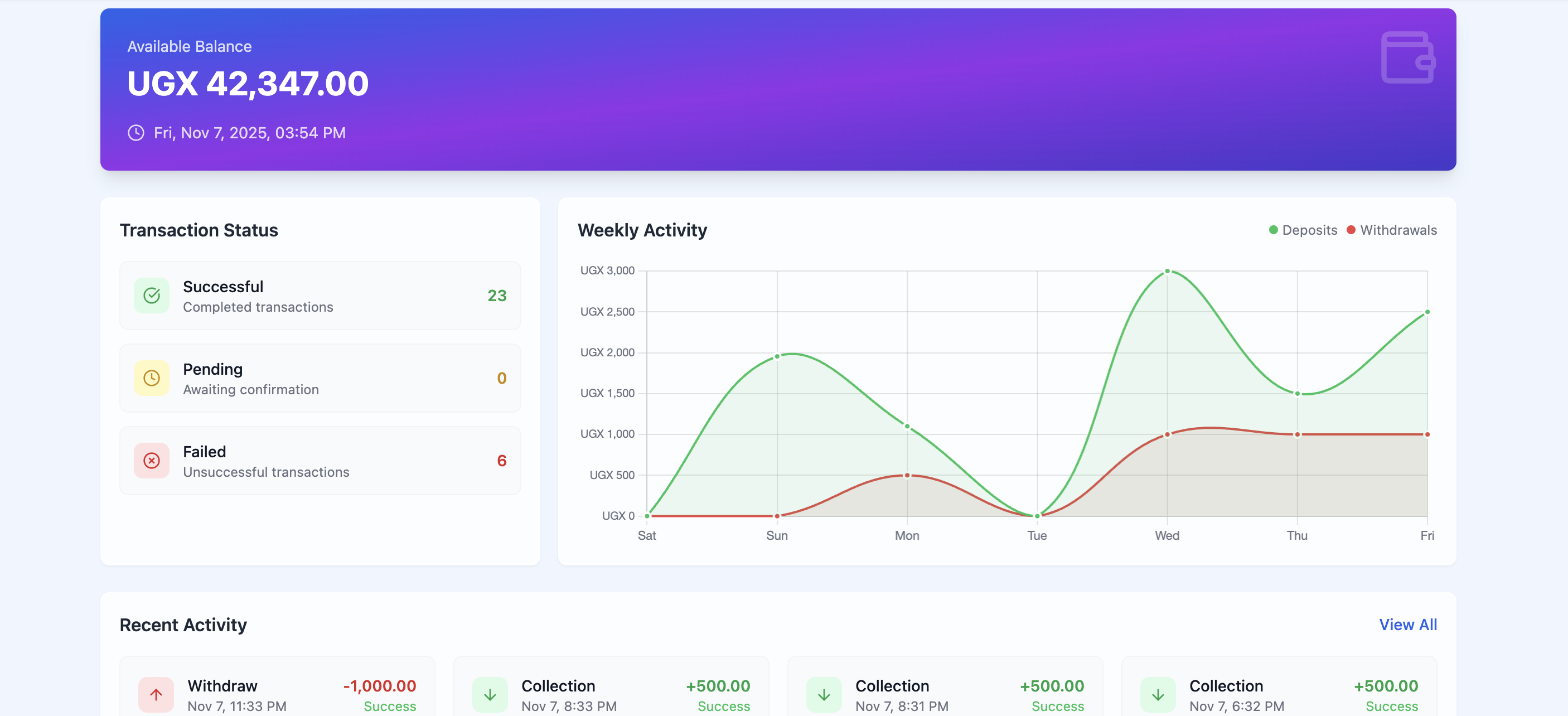

Cash flow is critical for small businesses. LivePaye offers instant settlements, meaning funds are processed and reflected in your wallet or bank account immediately, rather than waiting for the standard T+2 or T+7 days seen with some international gateways.

The platform is built for speed. It allows for both Collections (accepting money from customers) and Disbursements (sending money to vendors or employees) via the same interface.

LivePaye operates on a "pay-as-you-go" transaction model. There are no monthly fees, which is great for early-stage startups.

Collections (Mobile Money to Wallet):

- Fee: 3.5% per transaction.

- Limits: UGX 500 - 5,000,000.

- Note: This is slightly higher than standard credit card processing fees, but it captures a market that credit cards simply cannot reach.

Withdrawals (Payouts):

- Fee: 5% per transaction.

- Limits: Max UGX 1,000,000 per request.

-

Flutterwave & Paystack: The giants of African fintech. While they offer similar services, smaller startups often find LivePaye's support more accessible and their API documentation easier to navigate for specific mobile money use cases.

-

Direct Telco Integration: You could integrate directly with MTN or Airtel, but the bureaucratic red tape and technical debt usually make this unviable for small teams.

Most successful African startups eventually adopt a hybrid strategy: They use LivePaye for local mobile money transactions and Stripe for international subscriptions and card payments.

However, moving to Stripe comes with new risks: Chargebacks and Trial Fraud.

If you are using Stripe to scale your SaaS, you need to plug the revenue leaks that standard gateways ignore.

1Capture is a Stripe-partnered solution designed to secure your international revenue.

-

Eliminate "Card Testing" Fraud: Just as LivePaye verifies mobile numbers, 1Capture uses AI to block fraudulent card attempts and block serial disputers before they can checkout.

-

Smart Charge Pre-Auth: We apply a temporary, pending charge to a user's card at signup. This ensures the user actually has funds (reducing failed payments to 0%) without actually charging them until the trial is over. Learn more about our Smart Charge technology.

-

3.7x Revenue Growth: By filtering out low-intent users and fraudsters at the door, our partners see their trial-to-paid conversion rates soar up to 57%.

You've solved local payments with LivePaye. Now, solve global revenue retention with 1Capture.

Integrate 1Capture with your Stripe account in 5 minutes →