TrustMRR is a curated database and leaderboard of startup revenues that requires verification via API keys from platforms like Stripe, LemonSqueezy, or Polar. Built by Marc Lou (@marclou), it creates a "proof of work" environment where revenue numbers are pulled directly from payment processors and updated hourly. Key features include API-verified data, Month-over-Month growth tracking, and founder discovery. Currently free to browse, it serves founders who want to benchmark their growth against real peers and buyers/investors who want to scout for legitimate, growing assets. Verdict: TrustMRR is a breath of fresh air in an industry often clouded by hype. For founders, getting listed here is a badge of honor, a verified signal of legitimacy that can attract talent, investors, and customers. For observers, it is the best way to see what is actually working in the market right now. If you are tired of vanity metrics and want to see the real score, TrustMRR is the place to look.

TrustMRR Review: The Ultimate Truth Serum for SaaS Revenue

In the world of Indie Hacking and SaaS, X (formerly Twitter) can sometimes feel like a hall of mirrors.

Founders constantly post screenshots of "Hockey Stick" growth, but how much of it is real? Self-reported metrics are easy to fudge, and "revenue" can often be confused with "bookings" or other vanity metrics.

For investors looking for deal flow or founders looking for honest benchmarks, the noise can be deafening.

Enter TrustMRR.

This platform aims to bring radical transparency to the ecosystem by creating a leaderboard of startups with verified revenue. No Photoshop, no exaggeration, just raw data pulled directly from payment processors.

In this review, we'll explore what TrustMRR is, who is behind it, and why it might be the most important bookmark in your browser this year.

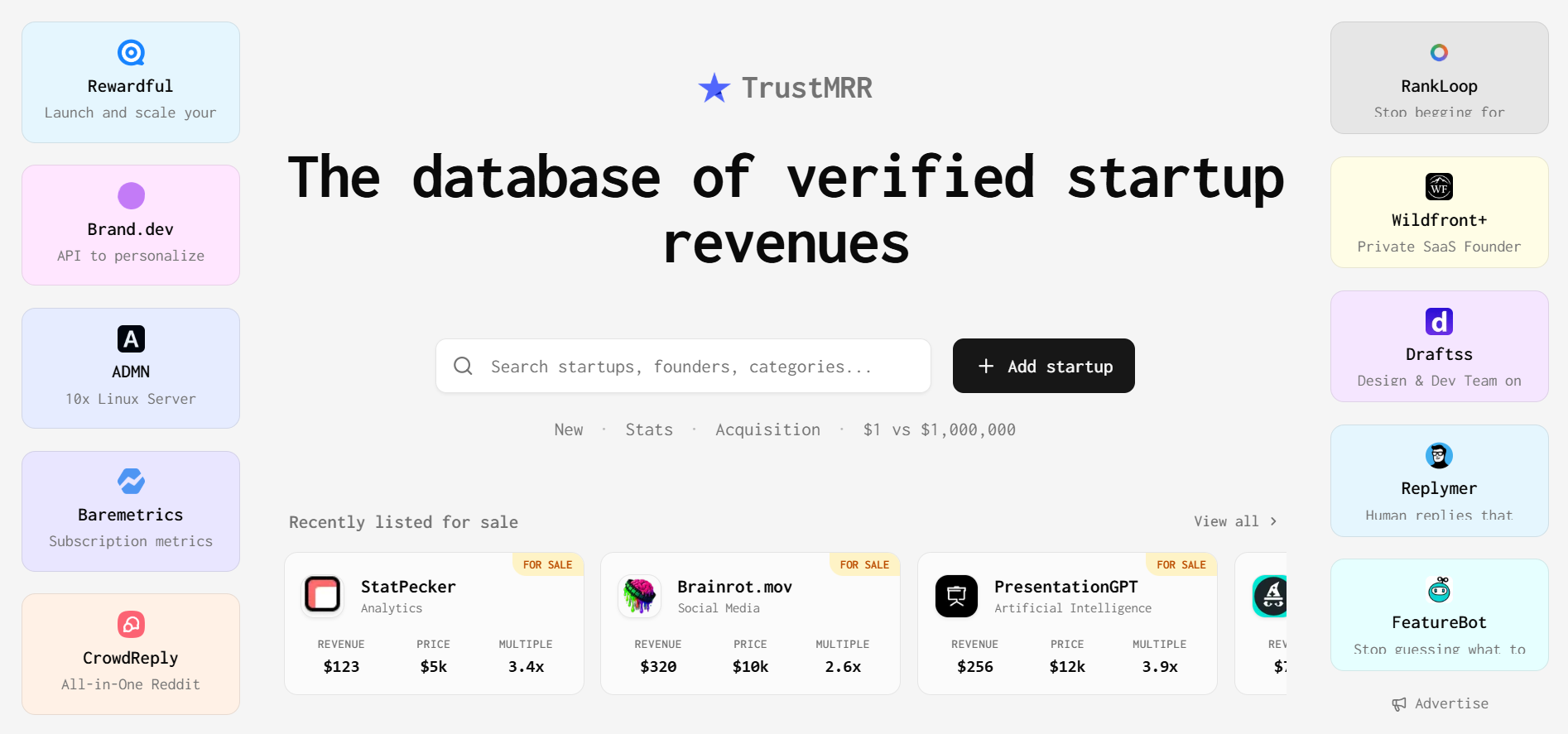

TrustMRR is a curated database and leaderboard of startup revenues. Unlike other directories where founders manually input their numbers, TrustMRR requires verification via API keys from platforms like Stripe, LemonSqueezy, or Polar.

This creates a "proof of work" environment. When you see a startup listed with $24,000 MRR (Monthly Recurring Revenue), you know that money actually hit the bank account. It serves two main audiences:

- Founders who want to benchmark their growth against real peers, not inflated influencers.

- Buyers/Investors: Who want to scout for legitimate, growing assets without doing hours of initial due diligence.

TrustMRR was built by Marc Lou (@marclou), a prolific indie hacker known for shipping multiple products rapidly (like ShipFast).

Marc has built a reputation for transparency, often sharing his own revenue metrics openly. TrustMRR feels like a natural extension of his personal brand, productizing the concept of "building in public" with actual verification.

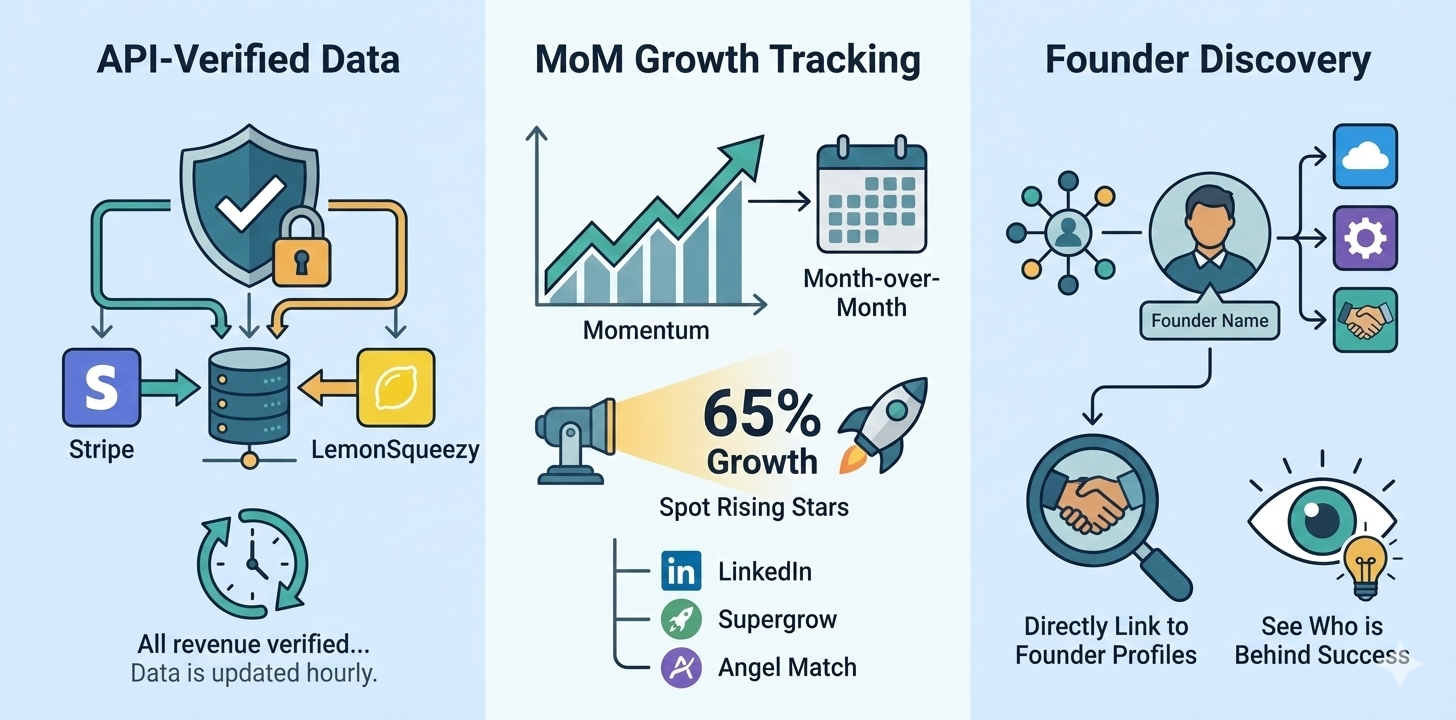

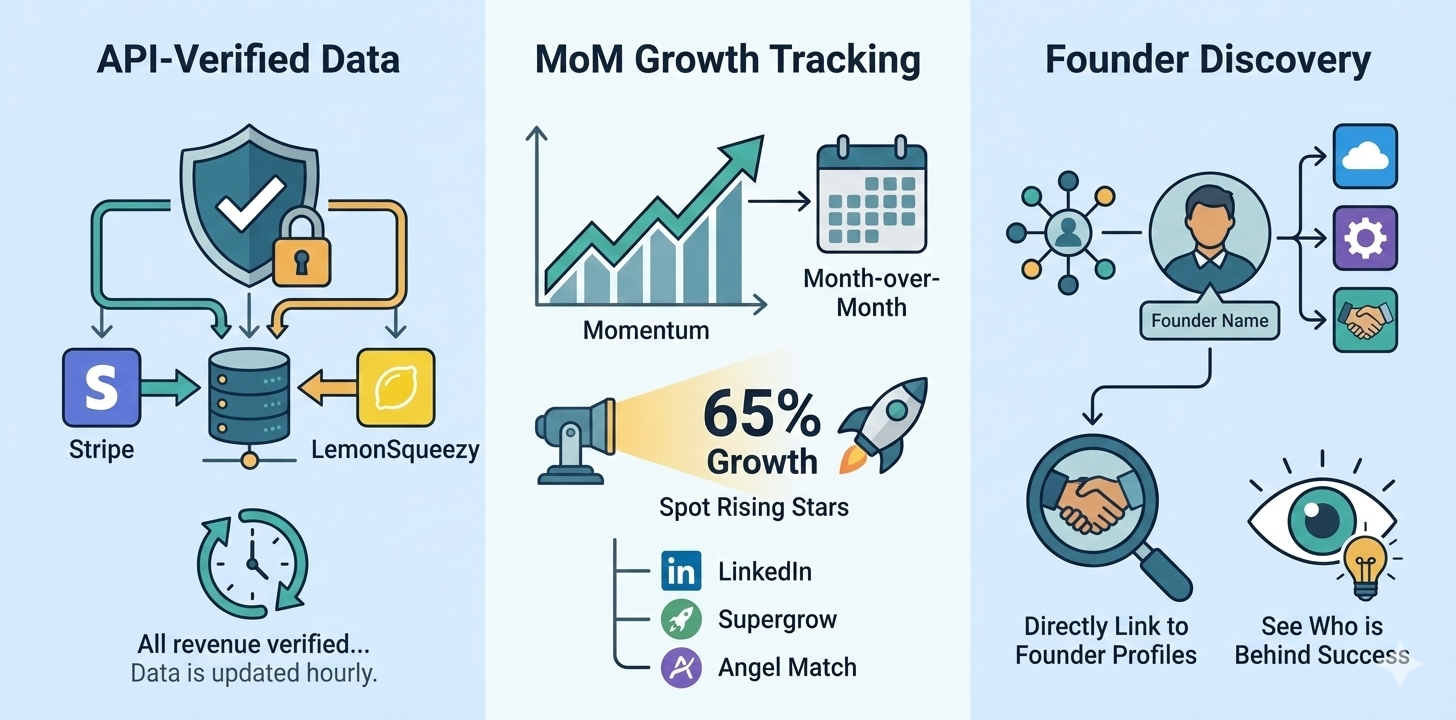

- API-Verified Data: The core value proposition. Data is pulled directly from the source (Stripe/LemonSqueezy). As the site claims, "All revenue is verified... Data is updated hourly."

- MoM Growth Tracking: It's not just about total revenue; it's about momentum. The dashboard highlights Month-over-Month growth percentages, allowing users to spot rising stars (like LinkedIn, growing at 65%) before they go mainstream.

- Founder Discovery: The platform links directly to founder profiles, making it an excellent networking tool. You can see exactly who is behind the success of tools like Supergrow or Angel Match.

Currently, TrustMRR is free to browse. The monetization model appears to be either through premium listings or through the ecosystem of tools Marc Lou sells to the founders who frequent the site. For the average user looking for data, it provides immense value at zero cost.

While unique in its verification method, TrustMRR competes with other data sources:

- Baremetrics "Open Startups": The original transparent revenue dashboard. However, it is limited to companies that explicitly use Baremetrics and opt in.

- Indie Hackers Products: A massive directory, but revenue numbers are often self-reported and not always updated in real-time.

- Acquire.com: While primarily a marketplace for selling businesses, it also provides verified metrics, but usually only accessible to approved buyers.

TrustMRR is a breath of fresh air in an industry often clouded by hype. For founders, getting listed here is a badge of honor, a verified signal of legitimacy that can attract talent, investors, and customers. For observers, it is the best way to see what is actually working in the market right now.

If you are tired of vanity metrics and want to see the real score, TrustMRR is the place to look.

Getting your SaaS on the TrustMRR leaderboard is a massive achievement. It means you have traction, customers, and cash flow. But as your revenue grows, you become a target.

According to data from Chargebacks911, subscription businesses face some of the highest rates of "friendly fraud" and chargebacks in the digital economy. Seeing $30k MRR on a dashboard is great, but if 5% of that is clawed back by disputes, your actual cash flow suffers.

We act as a shield between your checkout and your bank account, filtering out bad actors before they can damage your standing with Stripe.

- Block "Serial Disputers": We maintain a database of users known for abusing refund policies and issuing chargebacks. 1Capture blocks them instantly.

- Smart Charge Technology: Stop "card testing" fraud. Our pre-auth technology ensures a card has sufficient funds before granting access, reducing involuntary churn.

- Stripe Partner: 1Capture is a verified partner. You can integrate our protection in less than 5 minutes without writing complex code.

- 3.7x Revenue Growth: By preventing revenue leakage, our users see significant improvements in their bottom line.

Don't let fraud erase your hard-earned growth.

Check out the 1Capture Blog for more tips on preventing disputes, or visit our Pricing Page to secure your revenue today.