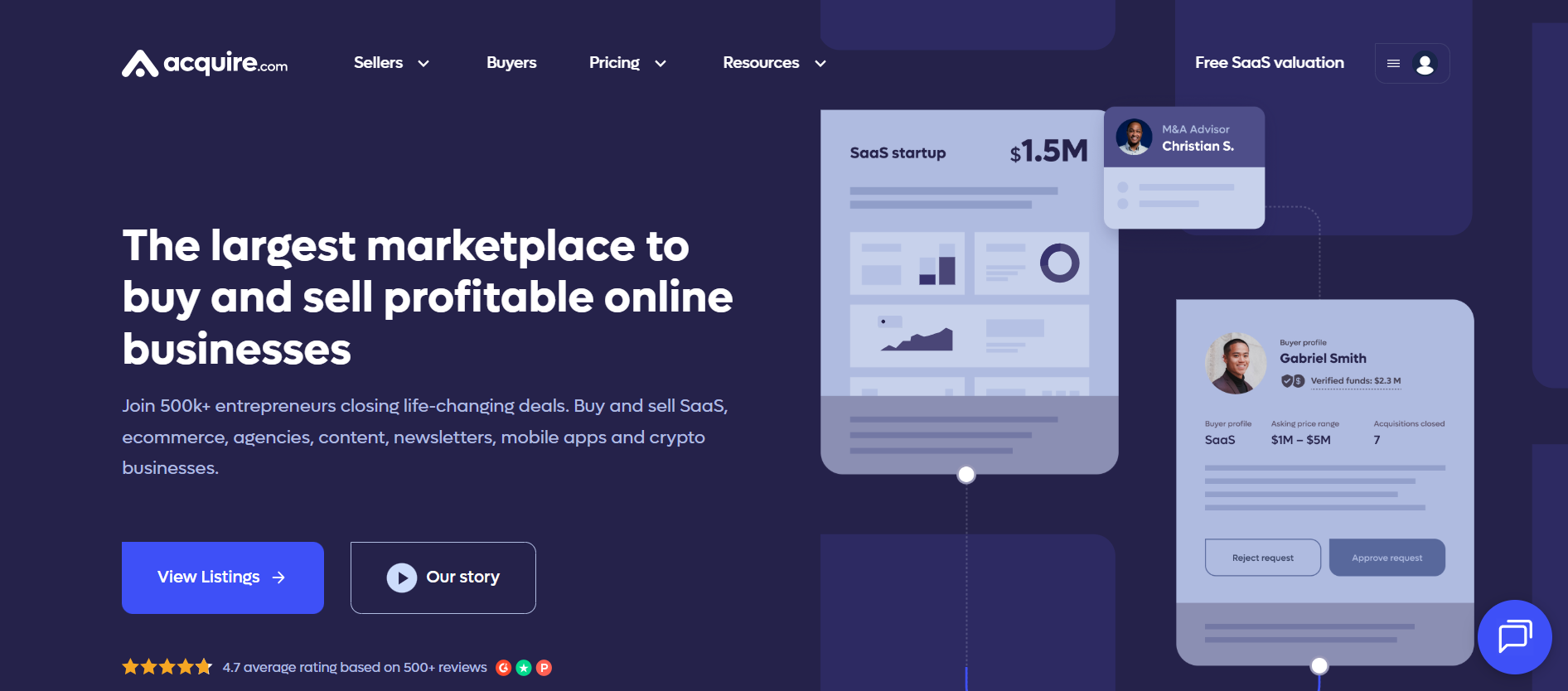

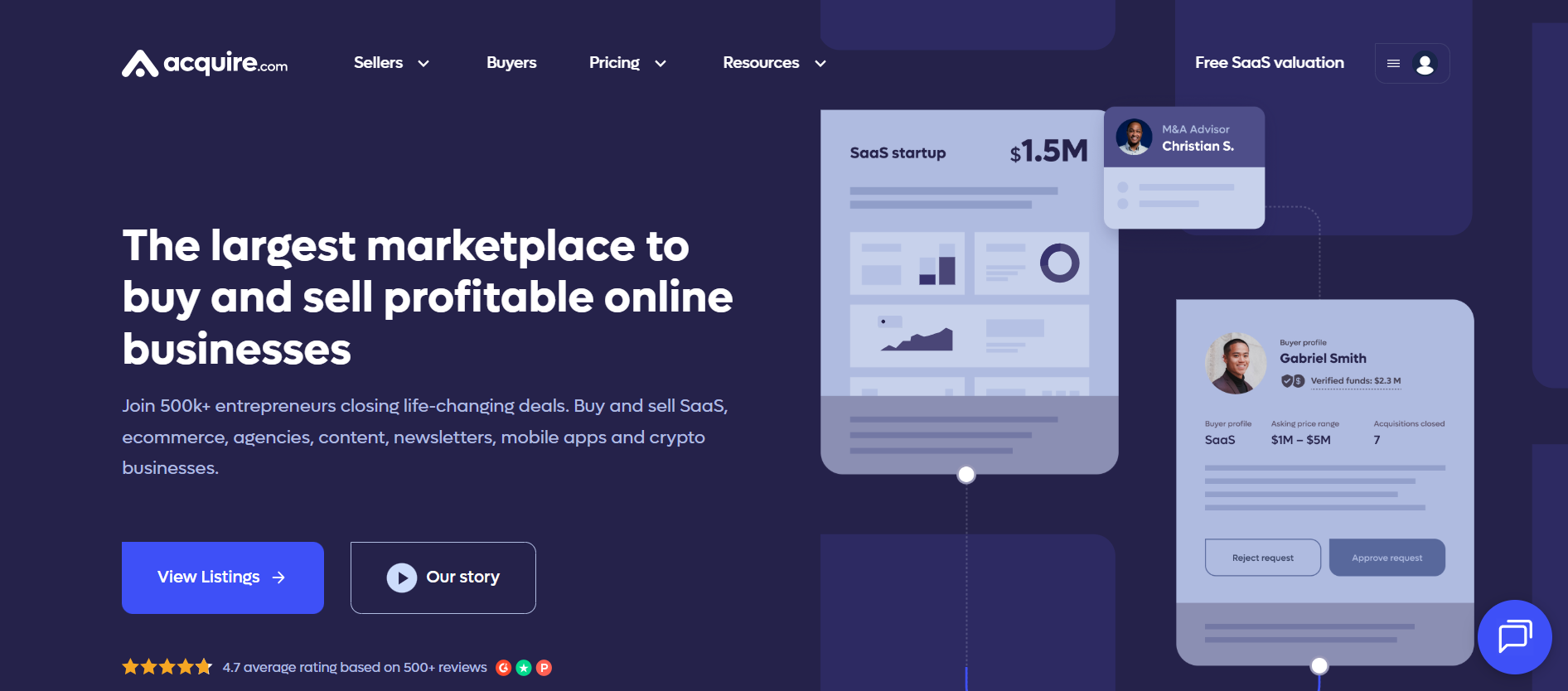

Quick Answer: Acquire.com is the world's largest marketplace for buying and selling profitable online businesses, with a heavy focus on SaaS, e-commerce, and digital agencies. Unlike traditional marketplaces that are often cluttered with "hopeful" but failing projects, Acquire emphasizes quality and transparency. The platform provides a streamlined workflow for both sides of the deal. Sellers can list their startups for free, integrate their financial metrics (like Stripe or ProfitWell), and get in front of over 500,000 entrepreneurs. Buyers, on the other hand, get access to a curated feed of startups with verified revenue and performance data. It acts as a "Visual Knowledge Base" for the M&A world, making deals fast, safe, and surprisingly easy. Acquire is the gold standard for modern SaaS founders looking for an exit. It removes the "vibe-based" negotiation and replaces it with hard data and direct communication. As HubSpot notes, a clear exit strategy is a hallmark of a healthy startup, and Acquire provides the most frictionless path to that goal.

Building a startup is a grueling marathon, but for most founders, the ultimate goal isn't just growth; it's the exit. However, the traditional M&A (Mergers and Acquisitions) world has long been gated by expensive brokers and "black box" processes that favor big players. According to Gartner, worldwide public cloud end-user spending is forecast to reach $679 billion in 2024, creating a massive secondary market for profitable SaaS businesses.

Enter Acquire (formerly MicroAcquire). It promises to democratize the acquisition process by connecting founders directly with vetted buyers. In this Acquire review, we'll look at whether this marketplace is truly the best place to get "Acquire'd" or if it's just another crowded listing site.

Acquire.com is the world's largest marketplace for buying and selling profitable online businesses, with a heavy focus on SaaS, e-commerce, and digital agencies. Unlike traditional marketplaces that are often cluttered with "hopeful" but failing projects, Acquire emphasizes quality and transparency.

The platform provides a streamlined workflow for both sides of the deal. Sellers can list their startups for free, integrate their financial metrics (like Stripe or ProfitWell), and get in front of over 500,000 entrepreneurs. Buyers, on the other hand, get access to a curated feed of startups with verified revenue and performance data. It acts as a "Visual Knowledge Base" for the M&A world, making deals fast, safe, and surprisingly easy.

The meteoric rise of Acquire is inseparable from its founder, Andrew Gazdecki.

Andrew is a three-time successful founder who built and sold BiznessApps and Altcoin.io. His frustration with the friction of the acquisition process led him to build MicroAcquire (now Acquire). Andrew's "Build in Public" philosophy on X (Twitter) and his commitment to founder-friendly terms have built immense "EEAT" (Experience, Expertise, Authoritativeness, and Trustworthiness) for the platform. He has effectively shifted the power dynamic from brokers back to the founders themselves.

- Vetted Listings: Every startup on Acquire undergoes a vetting process by their M&A team to ensure the metrics are accurate and the business is legitimate.

- Metric Integrations: Sellers can connect their Stripe, Baremetrics, or ChartMogul accounts to provide real-time, untamperable data to potential buyers.

- Buyer Verification: Acquire verifies buyer funds (currently over $2B in verified capital), ensuring that sellers aren't wasting time with "tire kickers" who can't actually close a deal.

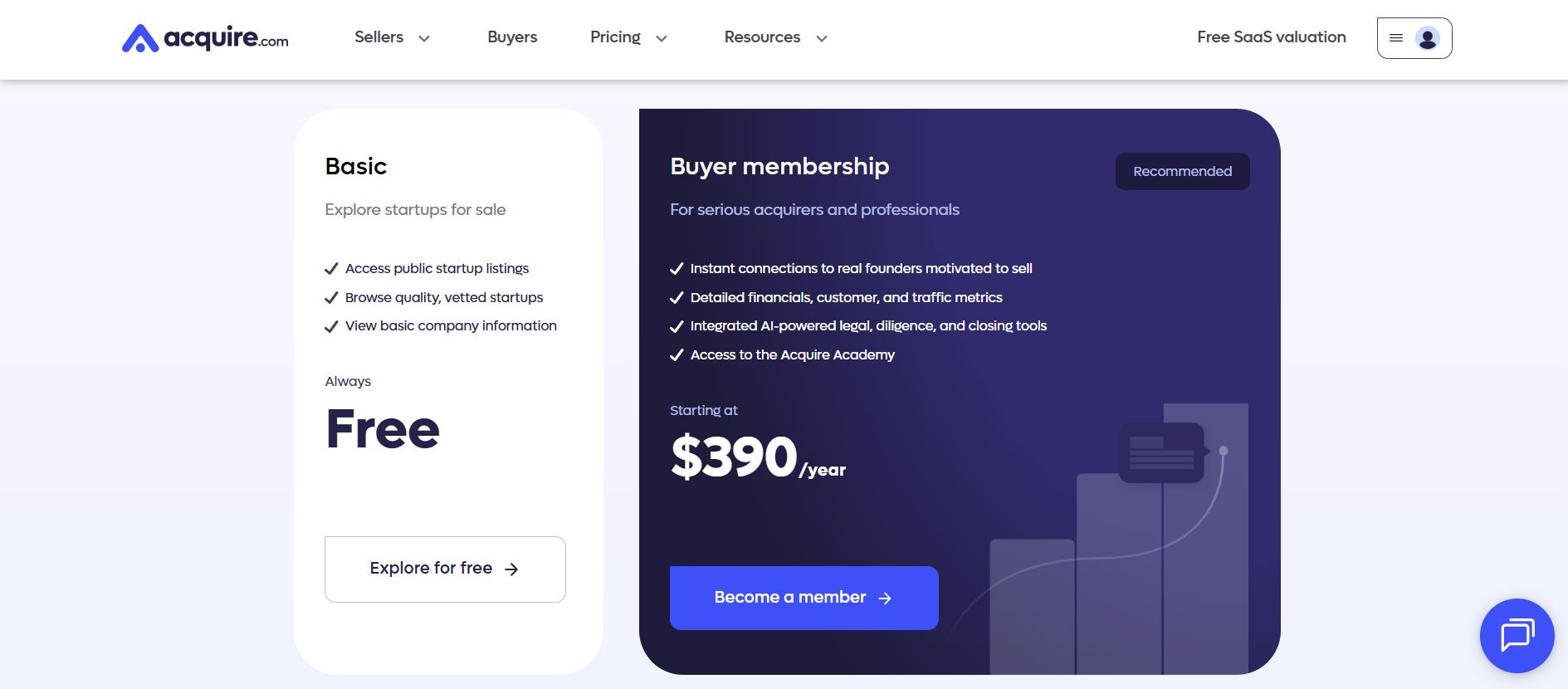

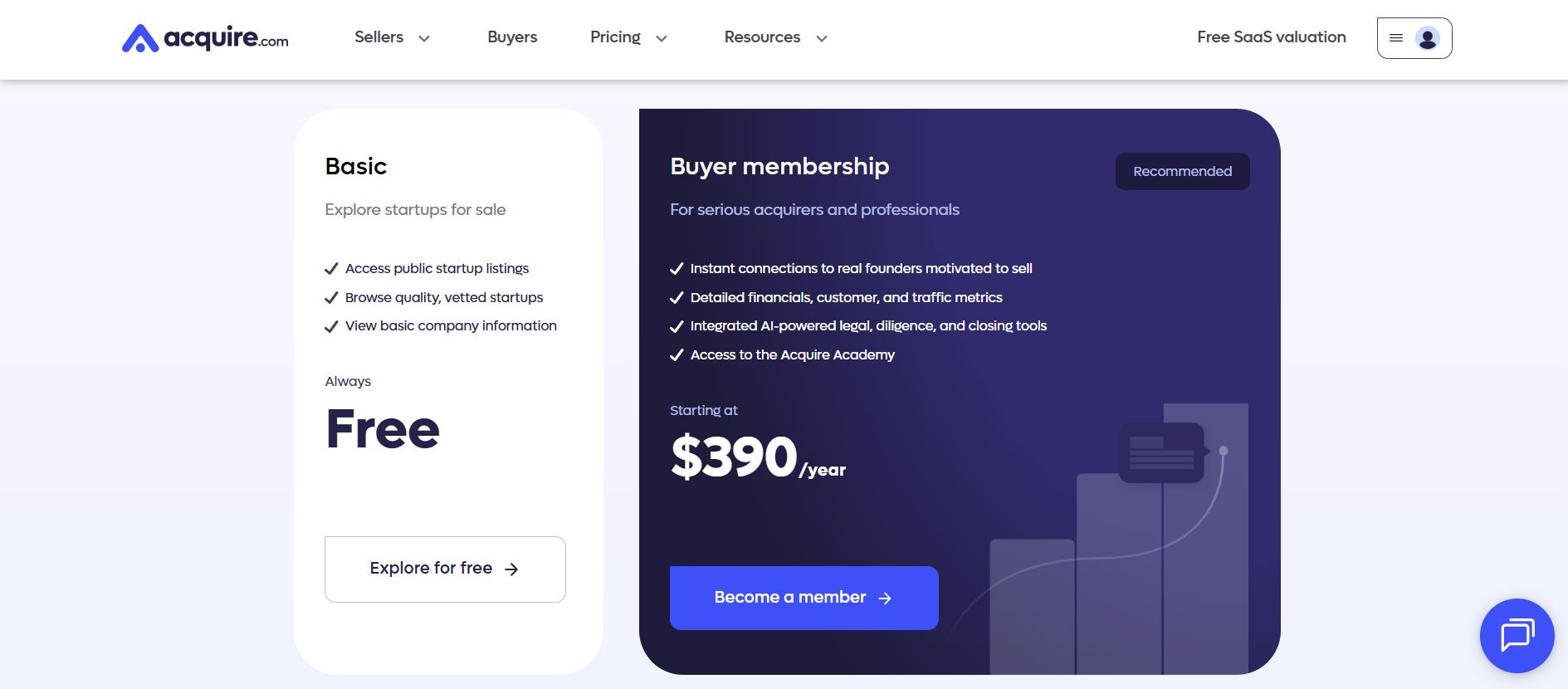

Acquire uses a tiered model designed to keep the marketplace high-quality:

- Sellers: It is free to list and sell your business. Acquire offers "Guided by Acquire" advisory services for a fee if you want expert M&A help to maximize your exit price.

- Buyers:

- Basic (Free): Browse listings but with limited access to private details.

- Premium ($390/year): Full access to all listings under $250k and the ability to contact founders immediately.

- Platinum ($780/year): Designed for serious acquirers and PE firms looking for high-ARR SaaS deals.

- Flippa: A massive marketplace that covers everything from $500 websites to $10M companies. It has more volume but often suffers from lower-quality "noise" compared to Acquire.

- Empire Flippers: A more traditional, "done-for-you" brokerage. They handle more of the heavy lifting but charge a significant commission (often 15%) on the sale.

- Quiet Light: A boutique brokerage that focuses on high-touch service for larger e-commerce and SaaS exits.

Acquire is the gold standard for modern SaaS founders looking for an exit. It removes the "vibe-based" negotiation and replaces it with hard data and direct communication. As HubSpot notes, a clear exit strategy is a hallmark of a healthy startup, and Acquire provides the most frictionless path to that goal.

If you want to sell your SaaS on Acquire for a 5x or 6x multiple, your "Net Revenue" is the only number that matters. Buyers on Acquire aren't just looking at your growth; they are looking at your Revenue Retention.

Nothing kills a deal faster during due diligence than a high chargeback rate or "revenue leakage" from failed payments. If you have "Serial Disputers" eating into your margins or malicious trial fraud inflating your churn, your valuation will tank. To get the best price on Acquire, you need to protect your revenue long before you list.

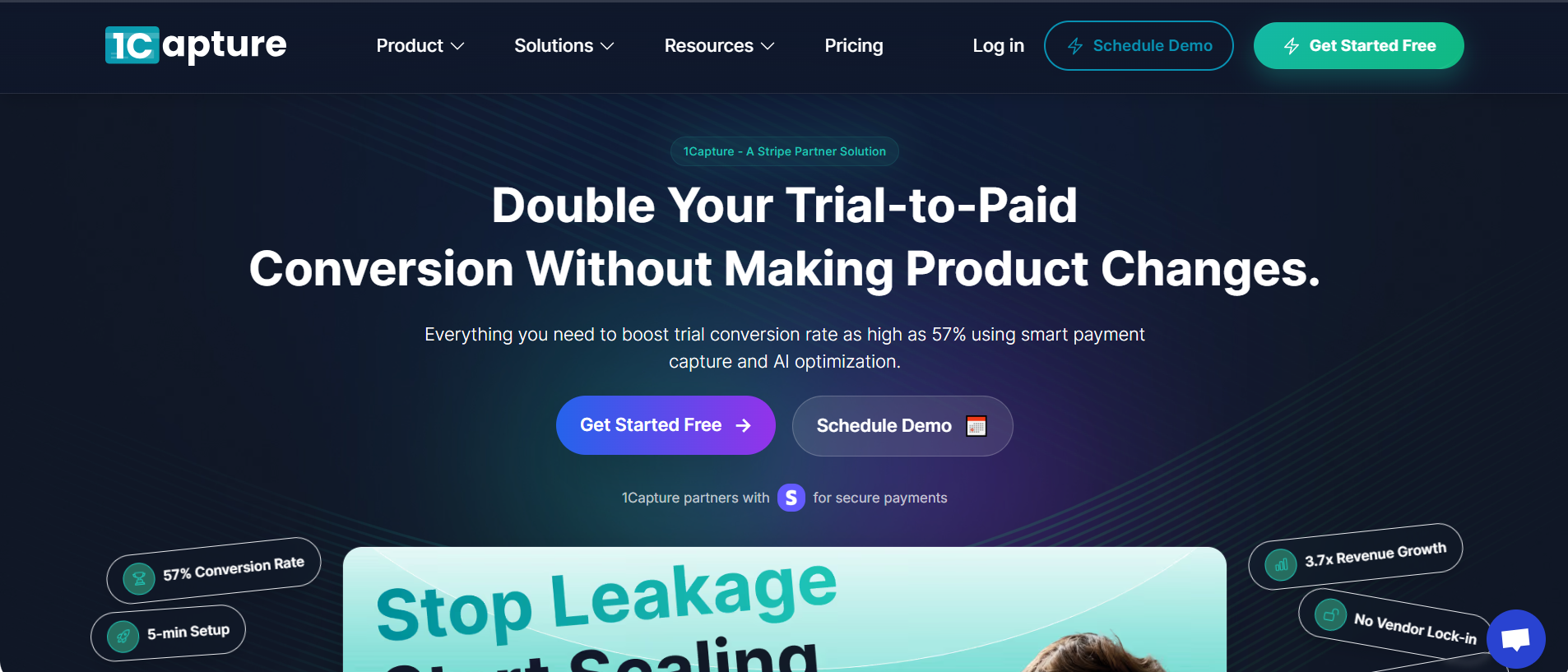

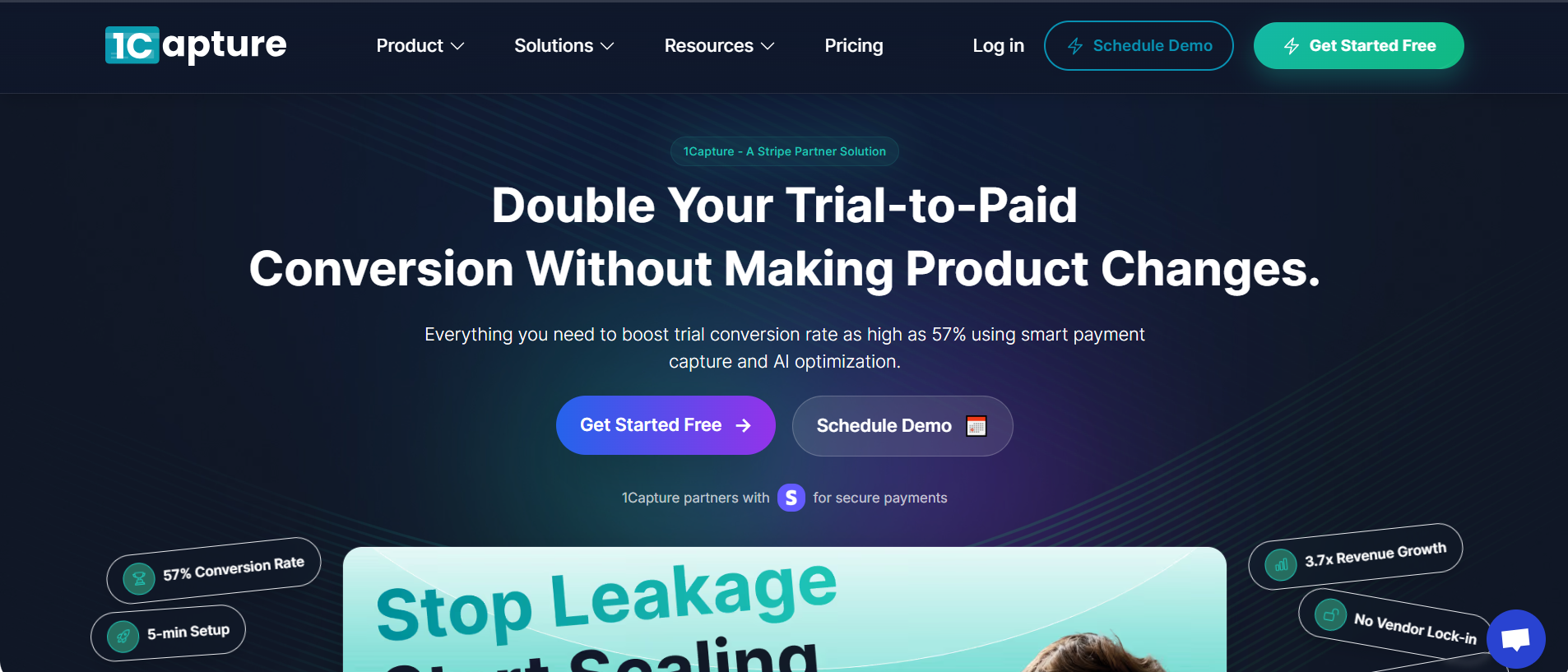

While you are building your SaaS to be "Acquire-ready," you need 1Capture to ensure every dollar you earn actually stays in your bank account.

1Capture is a Stripe-partnered revenue recovery and fraud prevention tool that acts as your brand's financial shield. While Acquire helps you find the buyer, 1Capture ensures that the business you're selling is as profitable and "clean" as possible.

- 5-Minute Setup: Plugs directly into your existing Stripe account with zero coding required, keep your focus on growth.

- Blocks "Serial Disputers": Our global database identifies users with a history of fraudulent chargebacks and stops them before they can sign up for your trial.

- Smart Charge Technology: Our proprietary Smart Charge system uses pre-auth logic to ensure funds are legitimate, drastically reducing failed payments that hurt your valuation.

- 3.7x Revenue Growth: By preventing revenue leakage and automating the recovery of failed subscriptions, 1Capture users see an average growth of 3.7x in retained earnings.

Don't let payment fraud devalue your life's work. Build your startup with Acquire in mind, and visit 1Capture Pricing to protect the revenue that will lead to your life-changing exit.

Learn more about revenue recovery on our blog.

Integrate 1Capture with your Stripe account in 5 minutes →